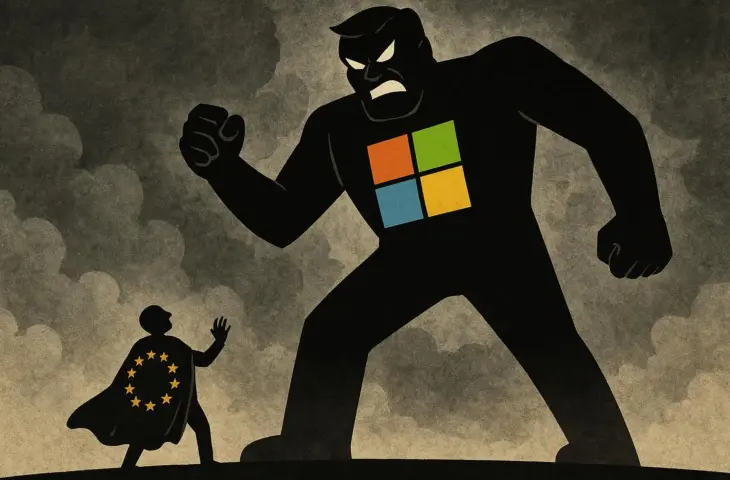

In times of geopolitical uncertainty, Europe wants to be less dependent on American cloud giants. Who are the European alternatives that have to compete against Microsoft and Google?

Sovereignty is more relevant than ever in the European IT sector today. The sector is dominated by foreign – mainly American – players. For a long time, this didn’t seem to be a problem, but now that Trump is causing geopolitical and technological tensions, Europe is realizing that it is too dependent on foreign technology.

The collapse of data agreements between the European Union and the United States would make the use of American cloud services “illegal”. Still a theoretical scenario, but one that would have disastrous consequences for all European organizations that are customers of Microsoft, Google or AWS if it were to become reality. Is it time to switch to a European cloud provider?

read also

The Cloud Illegal? Sovereignty as Holy Grail for European IT

Digital Colonialism

There is no shortage of cloud service providers in Europe. Yet it’s the American hyperscalers that dominate. According to a recent EuroStack report, “the big three” Microsoft, Google and AWS alone account for seventy percent of the European cloud industry. “Digital colonialism” is a real threat to the EU, the report concludes.

The unknown seems unloved in IT. Austrian developer Constantin Graf developed an online catalog with twelve providers offering cloud computing services. The French company OHVCloud might ring a bell, but only the diehards will have heard of Finnish UpCloud, Seeweb from Italy or the Dutch cloud platform Fuga Cloud.

Why do European companies find it so difficult to find European providers? Daniëlle Jacobs, CEO of Beltug, looks for an explanation. “Local providers simply cannot offer a stack on the same scale as Microsoft. They can replace parts of it, but then as a company you have to be willing to put your eggs in multiple baskets”.

Buy Local

Combell has a different opinion. The Belgian provider of cloud-based web hosting services believes that small players do have advantages over the large mastodons. “Although there is no European counterpart on the scale of a Microsoft or Google, the European cloud ecosystem has evolved strongly in recent years. The technological maturity is here”.

“For the vast majority of cloud services, European players can now offer full-fledged alternatives. Moreover, they offer additional assets such as data sovereignty, transparency and local support, which is becoming increasingly important for many organizations. As a Belgian provider, we can guarantee with certainty that data will remain within the EU”.

“With the right policy choices, the European ecosystem is certainly capable of absorbing a partial outflow of customers from the hyperscalers”, Combell vigorously defends the position of local cloud providers.

As a Belgian provider, we can guarantee with certainty that data will remain within the EU.

Combell

Belgian Cloud

That policy must primarily come from the European Union. The European institutions are coming up with ambitious plans around digital sovereignty, which so far lead to few actions, much to the annoyance of the entire IT industry. Jacobs: “The dependency on foreign vendors has long been dismissed because there was supposedly choice. European providers are unknown or are being bought by American companies. Once a software is implemented, companies don’t quickly leave their provider”.

read also

EU Sells Hot Air with Digital Sovereignty Strategy

Some member states are taking matters into their own hands. The Danish government is starting a test project to replace Microsoft software on government laptops and the Dutch parliament is calling on its government to throw out American technology. This should make the Belgian government think, Combell believes.

“Less dependence on non-European providers increases control over data and reduces geopolitical risks. A ‘Belgian cloud’ doesn’t need to be built from scratch. Local players have the technology, scalability and expertise. So now it’s a matter of fully committing to it as a country”.

Combell does not believe in aggressive countermeasures against its foreign competitors. “This could lead to higher costs for European companies that are already facing stiff competition. It is crucial that the EU primarily focuses on strengthening its own ecosystem”.

The End of Cloud-First

The uncertainty surrounding American technology could push European companies in another direction, away from the cloud. Jacobs sees this happening to a certain extent. A recent market study by Beltug shows that the number of Belgian companies with a “cloud-first” strategy has dropped significantly (from 26 percent in 2021 to 16 percent).

“Companies are no longer automatically opting for the cloud, and sovereignty is accelerating this evolution”, Jacobs explains the results. “If it’s scalable and especially feasible, companies prefer to keep their data to themselves. This can be on both on-premise and private cloud infrastructure. Besides data compliance, costs and vendor lock-in also play a role in this. Cloud-first has had its day, but not every company has an on-premise alternative”.

read also

David versus Goliath: where is the European Microsoft?

Combell does not expect to be out of work immediately. “The growing uncertainty around American technology may lead companies to reconsider their cloud strategy. We don’t expect a massive return from the cloud, but rather a shift towards hybrid and multi-cloud models”.