Haven’t switched to the mandatory digital invoicing via Peppol yet? Let’s check this off your to-do list once and for all.

As a self-employed professional or business leader, you can hardly avoid it anymore. Software companies are writing countless blogs about it or sending you emails to complete your registration. Yet, many companies are still not registered. To refresh your memory: Peppol is the new European legislation that requires companies to switch to e-invoicing from January 1, 2026.

Recent research by e-invoicing platform Lucy shows that one in three Belgian SMEs is postponing the switch to Peppol until the last quarter of this year. As it happens, we’ve now landed in the fourth quarter of 2025. So it’s time to cross the transition to e-invoicing off your to-do list together.

Peppol-ing

Whether you’re already registered for e-invoicing via Peppol or not, an extensive definition no longer seems necessary. Various accounting and software companies regularly remind you of the Peppol obligation.

For those who are panicking now, we’ll give a quick definition: Peppol is the new European legislation that requires all VAT-liable businesses to use electronic invoices from January 1, 2026. This digital transition should reduce paperwork, minimize the chance of errors, and ensure that invoices are paid faster.

Time is Ticking

Now that we’ve refreshed the definition, we can dive deeper into the Peppol phenomenon. The mandatory e-invoicing officially starts from January 1, 2026, and applies to all Belgian companies with a business number. This means that from then on, Belgian companies are required to send invoices, quotes, or credit notes via the Peppol network. It’s therefore wise to be prepared before that time.

Check Current Software

Time to dive into practice. The first important step is to register your organization with Peppol. Most accounting platforms are Peppol-compatible or are in the process of upgrading.

If your accounting platform already offers this option, it’s very easy to complete the registration. This differs for each platform, but you’ll likely see a Peppol button appear somewhere in the account settings.

Keep Itsme or your ID card handy to complete the registration. After the identification process, which takes only two minutes, your application is submitted. You’ll then receive confirmation that the registration was successful and receive a Peppol ID, which is your unique “address” within the Peppol network. You can compare it to an email address, but for invoices. Below you’ll find a list of Belgian accounting platforms that are already Peppol-compatible:

- Accountable

- Billit

- Flexina

- WinBooks

- Peppol box

Intermediate Platform

Is your current accounting platform not Peppol-compatible? Then there are intermediate platforms that are on the Peppol network. These so-called gateways or access points ensure that your invoices depart via Peppol, even if your accounting package doesn’t support it. Below you’ll find a list of Belgian gateways:

- Billit

- Banqup

- Peppol Box

- CodaBox

- ClearFacts

Such gateways can be a nice way for small businesses that prefer to stick with their trusted software, even if they’re not (yet) Peppol-compatible. Moreover, it’s also a simple and inexpensive alternative.

Creating E-Invoices

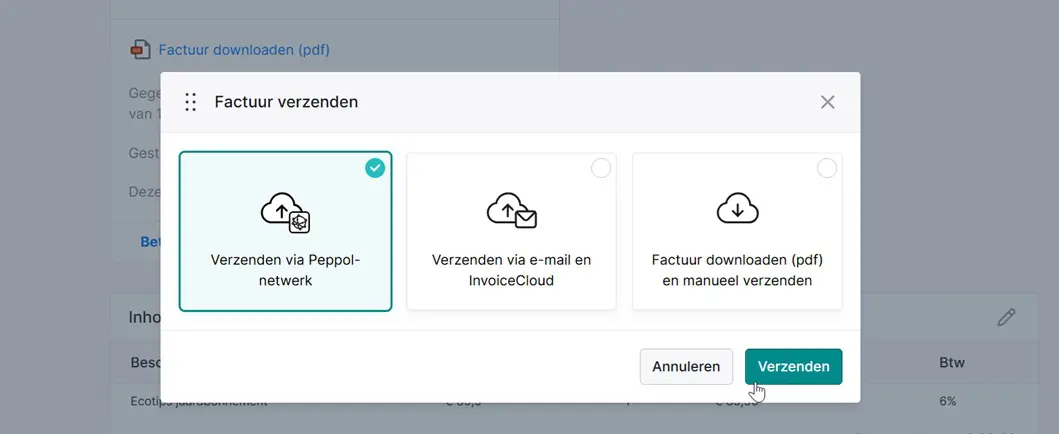

Once the registration is completed, you can start digital invoicing via Peppol. You’ll quickly notice that nothing has changed in the way you create invoices. You do this through the usual way in your accounting software.

What you invoice doesn’t change, but how your invoice is sent and processed does. Fortunately, this happens automatically via the Peppol standard, so you don’t have to do anything for it.

European Network

The legislation is clear. From January 1, 2026, you may no longer send regular PDF invoices to other Belgian companies unless there are exceptional reasons such as a temporary disruption. Since Peppol is a European network, invoices from international customers should also be sent via Peppol.

read also

Mandatory E-Invoicing as an opportunity: why Belgium is already investing in peppol

It’s important to mention that the European legislation actually only comes into effect from 2030. Belgium is thus well ahead of time and can be considered one of the frontrunners. Other countries that are (almost) on par with Belgium are the Scandinavian countries, but in the Netherlands, the basic infrastructure is already strongly present as well.

Invoicing to non-Peppol Users

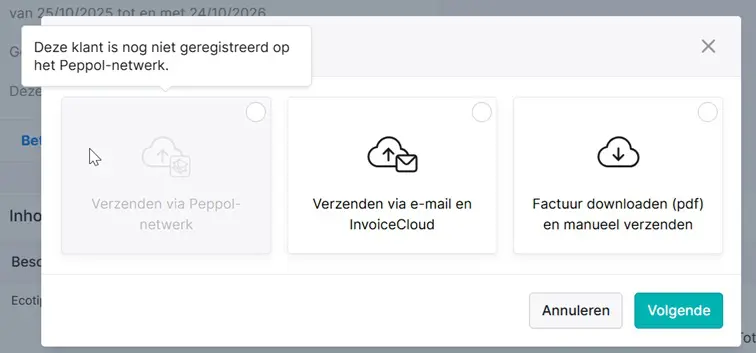

What if you still need to send invoices to (foreign) customers who don’t have a Peppol ID yet? Without a delivery address, Peppol won’t be able to deliver the invoice.

Most Belgian providers have an automatic ‘fallback’ in that case. This means that your invoice is created in Peppol format (XML), but doesn’t reach the customer. Your provider then ensures that the invoice is sent by email, including the PDF and the XML file as attachments. This way, the invoice remains legally valid.

If you still see an error message like “pending” or “failed delivery” on your invoice, you’ll have to fall back on the classic method and send the invoice through another channel, such as email.

Although Peppol is European legislation, countries can work towards the obligation at their own pace. This transition isn’t always easy because not everyone is at the same stage, but eventually, Peppol will become the future and reality for all European countries.