Which public cloud provider is the largest, and where do companies spend the most? A report from Flexera compares the hyperscalers.

In its State of the Cloud report, Flexera examines the public cloud sector. The public cloud industry has rapidly grown into a billion-dollar business, and the major hyperscalers are fiercely competing against each other. The report is based on a survey of 759 cloud decision-makers from North America and Asia.

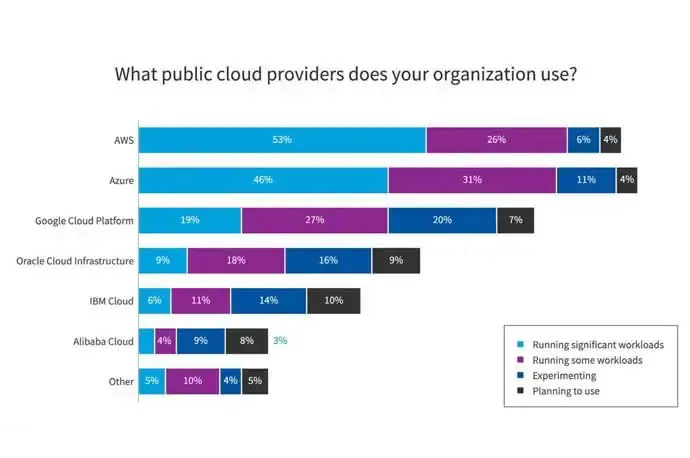

Slight Lead for AWS

AWS remains the largest cloud provider worldwide, although its lead over Microsoft Azure is narrow. 79 percent of respondents indicate running workloads on AWS, while for Azure it’s 77 percent. Companies clearly don’t limit themselves to one cloud. According to the research, AWS performs best in the SME segment, while Azure leads among the largest companies.

Google follows at a lonely height with 46 percent of respondents running workloads on it. Google’s cloud is most often used for experiments. 27 percent of respondents use Oracle, while IBM has to settle for 17 percent.

Expensive Bills

Cloud expenditures are increasing year over year, and for many organizations, the final bill runs into millions of dollars annually. 33 percent of enterprises spend more than 12 million per year on cloud services, with 11 percent spending even more than 60 million per year. 96 percent do enjoy some form of discount granted by the provider.

The budgets are logically more limited for SMEs than for enterprises. More than half of SMEs try to keep their cloud expenses below one million dollars per year, although there is a small minority that spends more than ten million dollars annually. For large enterprises, a cloud bill of more than 2.5 million per year is more the rule than the exception.

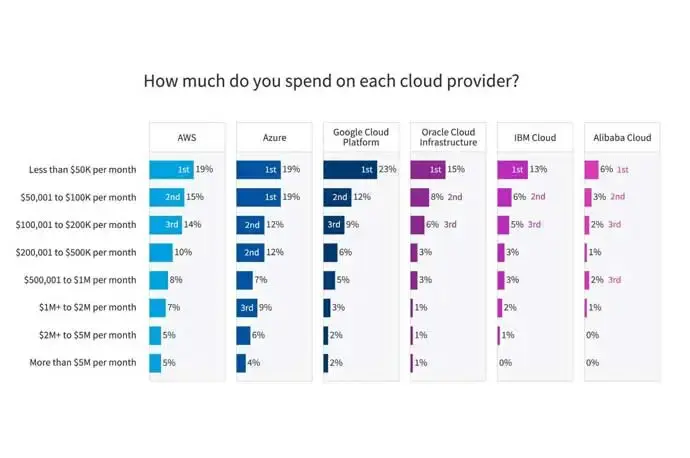

The Most Expensive Cloud

Expenditures are highest with AWS and Azure, with neither being visibly ‘more expensive’ than the other. Azure achieves a slightly higher percentage of companies spending more than a million dollars per year (19% compared to 17% in AWS), which can be explained by its stronger presence in the enterprise segment.

Companies with a more limited budget seem to opt for Google Cloud more often. 44 percent of customers spend less than 200,000 dollars per year on Google Cloud, and twenty percent less than 50,000 dollars per year. In the lowest spending segment, Google achieves the highest percentage. The complicated license formulas don’t make Oracle more expensive than the competition: only 3 percent of Oracle customers spend more than a million dollars per year.