Investors punish Salesforce for disappointing outlook. Agentforce adoption is slower than expected.

Salesforce shares dipped five percent after announcing its annual financial results: rarely a good sign. Salesforce, however, closed its fiscal year 2025 with great numbers. Total revenue grew nine percent to $37.9 billion. $35.7 billion came from cloud subscription revenues.

However, it doesn’t take much to cause panic among investors. Salesforce’s outlook fell short of expectations. Salesforce expects revenue of $40.5 billion for next year, but analysts had expected at least $41 billion. Investors see this as a sign that Agentforce is not yet the panacea Salesforce promises.

5,000 subscriptions

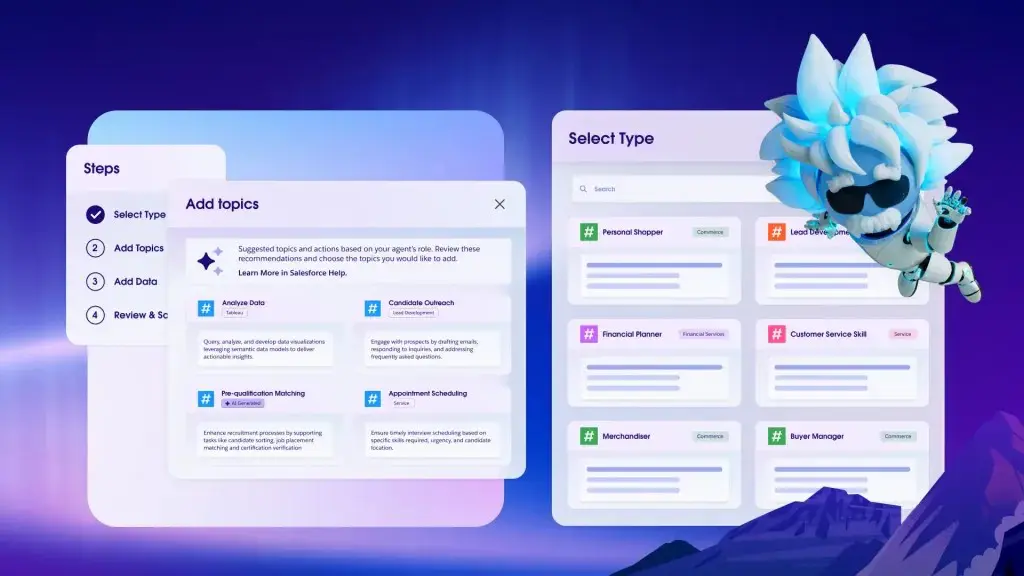

Salesforce announced Agentforce with much fanfare during Dreamforce, and even before the turn of the year, Agentforce 2.0 saw the light of day. Agentforce would make Microsoft’s Copilot irrelevant in no time. Not our words, but those of Salesforce CEO Marc Benioff, who was not shy about taking a jab at Microsoft. Agentforce was also supposed to officially usher in the era of “AI agents .

Since its launch, 5,000 companies have subscribed to Agentforce, 3,000 of them paying, Salesforce announces in its financial report. Those numbers are hard to compare with Copilot, since Microsoft’s AI assistant is deeply embedded in the 365 subscription. Potentially, Copilot thus has millions of users, but Microsoft is scarce with figures on how many people are effectively using the AI assistant now. ChatGPT took barely five days to get to one million users two years ago.

read also

Microsoft and Google ram AI down your throat (and make you pay for it)

Agentforce’s adoption is a result of the current investment climate, where companies must make do with limited IT budgets and/or be able to justify their spending. Salesforce will have to prove the added value of Agentforce: “Given how bad the initial generative AI experiments were for many companies, they won’t just write a blank check until Salesforce shows that Agentforce really works,” said a Reuters analyst .

AI bubble

The stock market is known for its capriciousness, especially when it comes to AI. Any kind of good or bad news is often met with an excessive reaction. Tech companies have made pretty promises around AI and investors don’t want to be knocked off their pink cloud. The AI bubble has been on the verge of bursting several times over the past few months, but the hype will not go away.

read also

AI agents: iPhone moment or old wine in new bags?

The epitome of AI madness is Nvidia. The company shot to unprecedented heights thanks to its monopoly on data center chips and was even, for a while, the most valuable company in the world. But even Nvidia cannot escape the whims of investors. The unexpected launch of DeepSeek led investors to believe that Nvidia’s golden era was over.

The figures announced by the company last night paint a different picture. Nvidia had another record year, making $22 billion in profits in the fourth quarter.