Intel is divesting 51 percent of its stake in FPGA specialist Altera. The sale, worth approximately 4 million dollars, follows an earlier spin-off of Altera.

Intel is selling 51 percent of Altera. Altera is an FPGA specialist. Intel acquired the company for 16.7 billion dollars in 2015, but lost interest in recent years. As Intel itself encountered rougher waters and built up an innovation lag in CPUs, it tried to narrow its focus again and let go of divisions not related to its core business.

read also

Intel Sells Majority Stake in Altera to Silver Lake

Intel completed the spin-off of Altera in January of this year, after which the FPGA division once again became an independently functioning company. However, Intel retained ownership. It was no secret that Intel was looking for investors.

Halving in Value

Intel has now found this in the form of private investment fund Silver Lake. Silver Lake is paying Intel 4.46 billion dollars for 51 percent of the shares, valuing Altera at 8.75 billion dollars. The math wizards among our readers will note that after ten years under the Intel umbrella, Altera has lost almost half of its value.

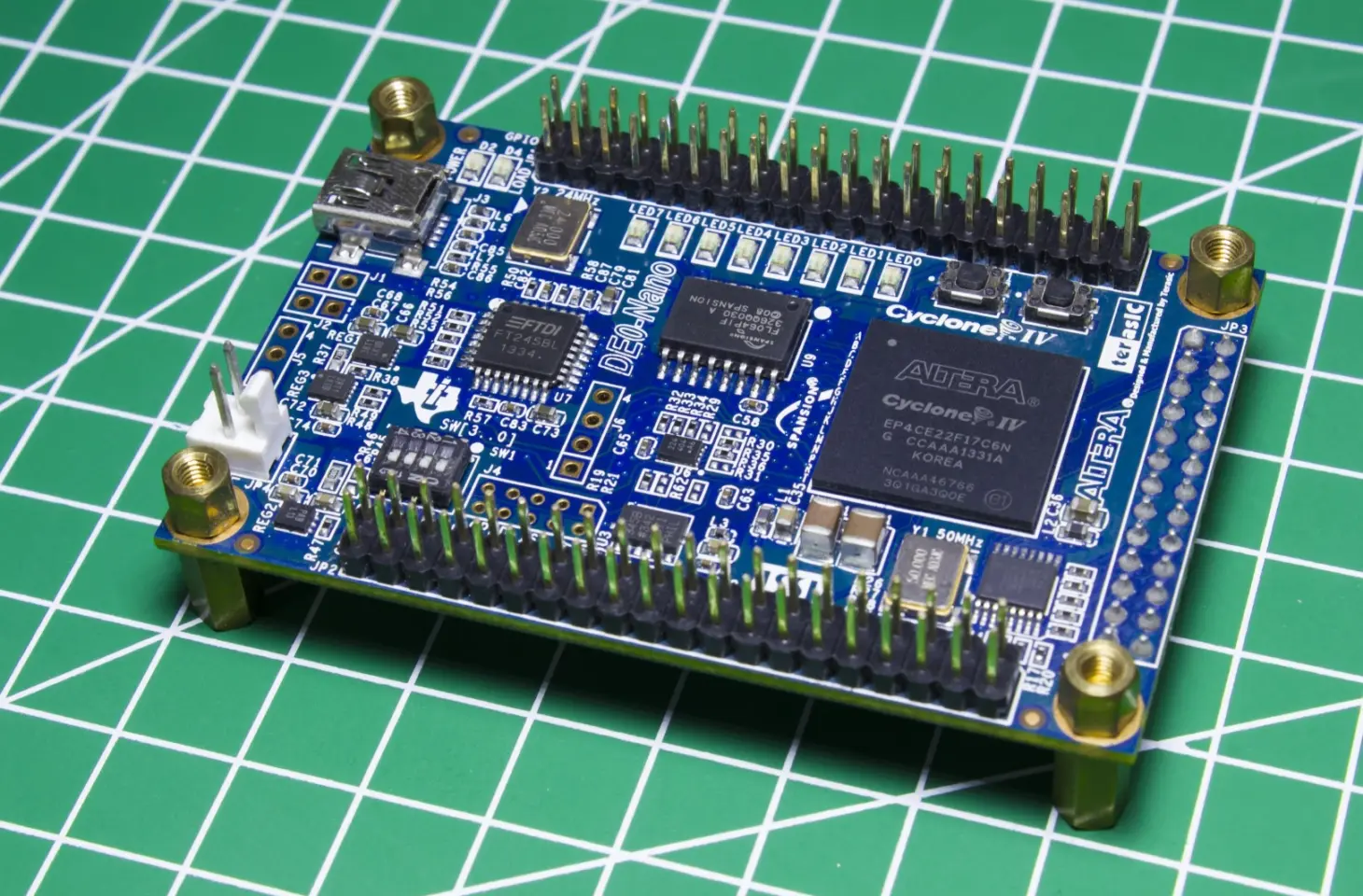

With the acquisition, Altera becomes the largest independent FPGA specialist in the world. The question is whether that’s a good thing. The previous largest player was Xilinx, but that company was acquired by AMD. The integration of Xilinx into AMD seems to be creating synergy on both sides at first glance.

Intel retains a 49 percent stake in Altera. The company will continue to work with Intel Foundry for chip production for the time being.