Nvidia continues to benefit optimally from the AI hype. The company once again posted strong quarterly figures, even without revenue from the Chinese market.

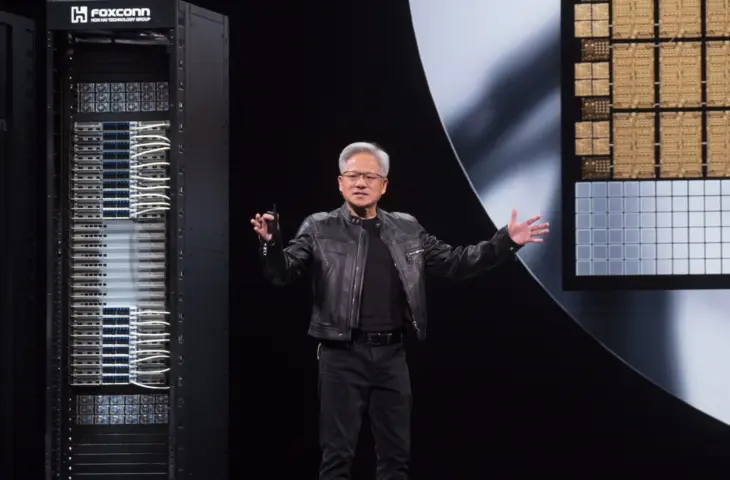

Investors and market analysts look forward to Nvidia’s financial figures each quarter. Jensen Huang and his team record dizzying numbers quarter after quarter, and there seems to be no ceiling to the growth. In the quarterly report that Nvidia made public last night, it’s throwing around billions as if they were candy.

Revenue increased by fifty percent compared to last year to $46.7 billion, while net income rose to $26.4 billion. The Blackwell chips sold like hotcakes. 50 percent of Nvidia’s income from the lucrative datacenter business could be attributed to the Blackwell generation. This marks the ninth consecutive quarter (!) that Nvidia has reported a revenue increase of at least fifty percent.

Uncertainty for China

Any company would kill for these figures, but the stock market reacted rather lukewarmly to Nvidia. That’s because revenue and profit could have been even higher. The American export restrictions have cost Nvidia several billion: $8 billion to be exact, according to Huang.

Nvidia hasn’t given up on China yet, but realizes that it won’t easily regain that market. In the forecasts for the current quarter, it doesn’t account for Chinese revenue. Nvidia recently received permission from the US government to sell the H20 chips specially developed for China again, on the condition that the government gets its share. An even more powerful chip based on Blackwell is reportedly in the pipeline.

However, it’s no longer the American but the Chinese government that’s working against Nvidia. Beijing is asking its companies to only buy chips ‘made in China’. Domestic production is being ramped up at a rapid pace, though this process has its ups and downs.

read also

DeepSeek R2 Faces Delays Due to Failing Huawei Chips

In the total calculation, the missed Chinese revenue is just a portion of the big pie. Nvidia is still doing very well. Since June, Nvidia has been the most valuable company and was the first to reach the mythical cap of $4 trillion in market value.